In order to boost spending on innovation, HMRC introduced Research and Development Tax Credits in 2000. They deduced that by reducing a company’s Corporation Tax liability this would encourage SMEs to invest more on R&D in the future. In 2002, this scheme was extended to larger companies.

In 2013, the Research and Development Expenditure Credit (RDEC) scheme was also introduced for large companies. After 2016, larger companies had to use the RDEC scheme as the large company scheme was no longer available, apart from in some exceptional circumstances.

In September 2021, HMRC released their latest ‘Research and Development Tax Credits Statistics’ report; it’s a long read, weighing in at 1800 words and a lot of graphs, so we’ve summarised some of the key points.

Number of claims

There have been an estimated 85,900 R&D tax credit claims up to 20 March 2020, an increase of 16% from the previous year. 76,225 of these claims were in the SME scheme.

Of the 76,225 SME claims, 38,050 were claimed as a tax deduction and 38,175 resulted in a payable tax credit.

The growth in the SME area is largely attributed to growing visibility of the scheme – more people know about it and so more people are able to claim.

Industries claiming

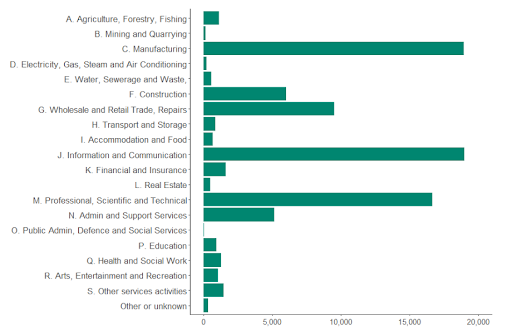

The greatest number of claims come from the following industries:

- Professional, Scientific and Technical (19%)

- Manufacturing (22%)

- Information and Communication (22%)

These sectors make up 63% of claims and 69% of the total value of R&D claims.

These are followed by:

- Wholesale and Retail Trade

- Construction

- Admin and Support Services

You can read more about Construction R&D Tax Credits in our recent publication: R&D Tax Relief for the Construction Industry.

Other industries are shown in the graphic below:

Source: Research and Development Tax Credits Statistics: September 2021 - GOV.UK (www.gov.uk)

Amount claimed

For the period ending March 2020, £7.4bn of R&D tax relief has been claimed – an increase of 19% from £6.3bn the previous year. This extrapolates to an estimated £47.5bn of expenditure on R&D across all claims. This is an increase of 15% on R&D expenditure from the previous year.

First time applicants

Each year there are more and more first-time claimants, with 2017-2018 showing an increase of 10% in first time applicants over the previous year. 15,750 people claimed R&D tax relief for the first time, largely in the SME sector.

Location

The R&D Development Tax Credit Statistics report shows that the majority of companies claiming are based in London, the South East or East of England. These amount for 20% of all claims and 31% of the total amount claimed for the year ending March 2020. There is a disclaimer in the document, though; the regional split is based on the registered head office location, which may not actually be where the Research and Development takes place. Many smaller companies, for example, may have a London based Head Office address, but the R&D department could be anywhere in the country.

Can my company claim?

To qualify for R&D tax relief, a company must be able to prove to HMRC that they have spent money on research and development. This must also be in the science and technology areas of R&D, although as you can see from the chart above, the company itself does not have to be a science or technology company.

There are nearly 5.5 million companies in the UK. There have been 85,900 R&D tax credit claims up to 20 March 2020. That leaves a LOT of companies that are doing exciting and innovative things in the R&D sector that still haven’t claimed tax relief to which they are entitled. Yours could be one of them.

At HB R&D Consultants we believe in a hands-on approach and endeavour to work closely with our clients to ensure that each and every claim submitted is correct, maximised and low risk. Find out whether you qualify to claim, find out more about our method and get in touch now to see what your company could be claiming from the R&D Tax Credits Relief scheme.