Development of Regenerative Principles for the Built Environment

01603 213444 | enquiries@wilbyjones.co.ukHOMEABOUTTHE TEAMOUR METHODPUBLICATIONSCONTACTHOMEABOUTTHE TEAMOUR METHODPUBLICATIONSCONTACTHOMEABOUTTHE TEAMOUR METHODPUBLICATIONSCONTACTHOMEABOUTTHE TEAMOUR METHODPUBLICATIONSCONTACTArchitectureEngineeringProduct DevelopmentIT SoftwareFood & DrinkPublicationsMeet The TeamArchitectureDevelopment of Regenerative Principles for the Built EnvironmentA New Typology for WineriesDevelopment of Sustainability Strategies using AIConnecting with nature – bringing the outdoors inCork House: Pioneering the Future / Cork Talk: Building (Blocks of) the FutureThe UK’s first ... Read more

A New Typology for Wineries

Our client was commissioned to design an innovative new winery and visitor centre within the heart of the English countryside. Although well-established on the continent, viticulture is a rapidly growing phenomena in the UK, with sparkling wine the focus of production. The development of a new typology presented the practice with technical challenge: the winery, ... Read more

Development of Sustainability Strategies using AI

Our client’s brief was to create a new, highly sustainable residential community with small-scale ancillary facilities. The intention was to produce a highly sustainable design which referenced the unique history of the site, a former shipyard. A highly efficient energy strategy was developed through using the latest Artificial Intelligence to optimise thermal modelling software. The ... Read more

Connecting with nature – bringing the outdoors in

This project centred around the design of an exciting and innovative outdoor-indoor adventure activity ‘Serendome’. The idea of the dome was to experience outdoor activities under a 'giant umbrella' so that families could enjoy the thrill of the outdoors whatever the weather. For the architects to fulfil the unusual brief set out by their client ... Read more

Cork House: Pioneering the Future / Cork Talk: Building (Blocks of) the Future

‘Pop!’Synonymous with the sounds of celebration, the familiar cork pop now heralds the arrival of a low-carbon future. Naturally waterproof and breathable, cork’s qualities are now being recognized by architects. Innovators in sustainable design, our client has led the way in refashioning cork from a wine staple into a primary construction material. Cork is harvested ... Read more

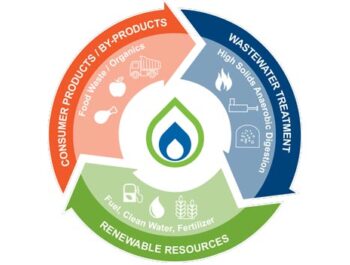

The UK’s first food park with integrated Energy and Waste Management

Our client was hired as part of a joint development of the UK’s first food park with integrated energy and waste management systems. The world class multi-million-pound development would transform the wider economy as well as providing a modern distribution hub and renewable energy infrastructure. The key challenge of the project for our client involved ... Read more

The UK’s First Biophilic Living Scheme

Our client’s brief was to redevelop a former retail store into a mixed-use development and tower block featuring residential, retail, and office space. The project was to be designed following the principles of Biophilia, promoting sustainability in terms of environmental impact and economic viability. Biophilic architecture refers to the adaptation or design of a building ... Read more

The UK’s First Gas Free Hospital

Our client’s brief was to develop a design for a new environmentally friendly hospice building with future flexibility in mind. The intention was to produce a building that was highly sustainable and exceeded Building Regulation in terms of sustainability. A highly efficient energy strategy was developed which combined the use of passive design measures which ... Read more

Development of a Novel Footbridge in Cornwall

Our client’s brief was to redesign a footbridge on an incredibly sensitive site in Cornwall. The site was inaccessible and also was a registered ancient monument, an area of outstanding natural beauty and of particular scientific interest. Material use and performance were the key drivers of innovation. Their client wanted a very durable structure that ... Read more

Church Renovations To Reduce Energy Consumption

Our client’s brief was to undertake the renovations of an old church. The brief required an unconventional method of warming the church building which sought to reduce energy consumption and visual impact of existing heat appliances whilst maintaining a comfortable temperature at all times. Typically, churches are heated by a series of radiators at the ... Read more

Luxury Ski Chalets

Our client’s brief was to design three luxury ski chalets in a world-renowned ski resort in the French Alps. Material performance and aesthetics were key aspects of the brief as the design needed to consider the harsh weather conditions in the Alps as well as achieving high quality, energy efficient constructions that would be desirable ... Read more

Educational STEM Centre in Kazakhstan

Our client’s brief was to design a state-of-the-art, ‘one-off’ piece of architecture for an educational STEM Centre in Kazakhstan. The intention was to produce a building that could provide a space for science-based subjects. The structure of the building was to take inspiration from the science-based learning occurring with it, and as such, a unique ... Read more

Q&A with Jacob Low of JaK Studio Architects

Here at Wilby Jones Consulting, we specialise in supporting architectural and design firms through the R&D tax relief process (although we also work with companies from other sectors, too). One such firm is JaK Studio: A RIBA Chartered design studio, with ties to London, Sarajevo, and Riyadh. We’re proud to have helped JaK achieve a ... Read more

Client Q&A: Felix Finkernagel of Finkernagel Ross

Although we work with clients from different sectors, we specialise in helping architects benefit from R&D tax relief. In fact, over 60% of our clients work in architecture, with a further 15% working in related fields such as engineering. To help you get a better idea of what it’s like to work with Wilby Jones ... Read more

R&D tax relief guide for architects

We’re Wilby Jones Consulting: specialists in R&D tax relief for architects. Welcome to our online guide to R&D relief for architects. As R&D tax relief consultants, one of our biggest challenges is educating businesses about this under-utilised tax incentive. There’s a bit of a misconception that only dedicated R&D firms can apply for R&D tax ... Read more

Wilby Jones explores green innovation in the built environment

The 2015 Paris Agreement represents a turning point in the fight against climate change. Countries around the world committed to stop the rate of global warming exceeding 1.5 C (considered the temperature threshold to catastrophic global warming). To meet those targets, the UK is legally bound to achieve an 80% carbon reduction by 2050. In ... Read more

Historic Bridge Scour Protection

01603 213444 | enquiries@wilbyjones.co.uk

3D Scanning Techniques for Nuclear Decommissioning

Our client was appointed to create a specialist remote 3D laser scanning method for use on a contaminated site at a former nuclear facility. The main objective of the project was to make a scan of the building to internally survey the main cell to enable a 3D model of the internal cell configuration to ... Read more

Beautiful Biomimicry – The Dino Bridge

Our client, in conjunction with architects and structural engineers, was hired to develop a bridge for the Crystal Palace Dinosaur Park which would improve access to the heritage island for maintenance and educational purposes. The dinosaurs, built in 1854, are set in landscapes that attempt to reflect 400 million years of geologic time, and presented ... Read more

Tidal Defences That Preserve Marine Ecology

Typically, seawalls are constructed using reinforced concrete panels which provide important structural reinforcement to marine structures, however, can be detrimental to marine biodiversity. The concrete on the surface of the panels can be toxic to marine life, including microorganisms, which can result in disruptions to the ecosystem. Based on a global research project on the ... Read more

Reverse engineering and development

Reverse engineering and development of new cladding in line with post Grenfell regulationsOur client, a prominent engineering company in London, have been at the heart of innovation in fire safe cladding since the Grenfell tragedy in 2017. A part of their workload has been the analysis of existing tall buildings in and around the city ... Read more

Recording Studio Interference

Our client, a company specialising in the design, build and installation of bespoke recording studios, have been leaders in innovation of in their sector since 2005. One of their recent projects presented some unique challenges which required an innovative touch to tackle. A recording studio was to be built in the heart of London, and ... Read more

Church Renovations To Reduce Energy Consumption

Our client’s brief was to undertake the renovations of an old church. The brief required an unconventional method of warming the church building which sought to reduce energy consumption and visual impact of existing heat appliances whilst maintaining a comfortable temperature at all times. Typically, churches are heated by a series of radiators at the ... Read more

R&D tax relief for the construction industry

Construction is one of the largest and most established industries in the UK, employing 3.1 million people or over 9% of the workforce. However, firms in the construction industry are not making the most of their eligibility to qualify for R&D tax relief. HMRC’s 2020 R&D Tax Credit Statistics Report revealed that construction firms made ... Read more

Exploring R&D and fire-safe construction

Following the tragic Grenfell Tower fire incident in 2017, the UK has seen a major review into its fire safety regulations for tall buildings. While this is of course, long overdue, it is the very least that can happen to keep people safe in their own homes. As part of this, much research and development ... Read more

R&D tax relief for engineering firms

Welcome to Wilby Jones Consulting’s guide to R&D tax relief for engineers. Although we support businesses from many sectors with their tax relief claims, we’re specialists when it comes to R&D relief for engineering firms. This means we’re able to give you advice that’s tailored to your business. Our engineering clients are able to simply ... Read more

Development of a reusable aerosol can

The project entailed the development of a spray can design that could be used to create refillable and reusable aerosol products whilst using recyclable packaging and without the use of pressurised flammable gasses, such as butane and propane. Our client spotted a gap in the market in that there is no pump spray bottle available ... Read more

How do subcontractors affect R&D tax relief?

The issue of subcontractors and R&D tax relief is one that causes a lot more uncertainty than it needs to. A lot of SMEs mistakenly believe that they either can’t claim R&D tax relief for projects that have involved subcontractors, or even that the subcontractors are the ones entitled to the incentive from HMRC. However, ... Read more

A New Era of Film Making

Our client, a leading innovator of specialist acoustic design, was appointed to provide acoustic consultancy for the filming of a new superhero film. The filming process made extensive use of ‘virtual production’ – a rapidly growing area of content production combining CGI, game-engines, and virtual reality technologies in which large LED walls are used as ... Read more

HR Software Package

Development of a first in class human resource software package Our client who are a company of software engineers and human resource experts in Surrey developed a human resource software package that went above and beyond anything available on the market. Their new system aimed to support the individual development and performance management of users ... Read more

Our client developed a new hydration powder which was the first of its kind in several areas. The client had to undergo a rigorous testing process in order to get approved and, due to the unique make up of the product, to be approved by users across the UK. Within the hydration powder, our client ... Read more

Like many other businesses in the food and drink industry, alcohol manufacturers may have cause to benefit from HMRC’s R&D tax relief incentive. This article explains everything you need to know… What is R&D tax relief? R&D tax relief is a statutory tax relief scheme implemented by HMRC. Businesses that can prove that they have ... Read more

Highlights from HMRC’s Research and Development Tax Credits Statistics Report 2021

In order to boost spending on innovation, HMRC introduced Research and Development Tax Credits in 2000. They deduced that by reducing a company’s Corporation Tax liability this would encourage SMEs to invest more on R&D in the future. In 2002, this scheme was extended to larger companies. In 2013, the Research and Development Expenditure Credit ... Read more

Boosting Youth Employability with Innovative Partnerships

Sadly, not everyone has access to a great education, university, a gap year and excellent job opportunities. Indeed, there are thousands of children and young people across the world that haven't had these privileges. They have had to deal with a lack of parental support or just not enough money to be able to pay ... Read more

Quick Guide to Taxation in Building Design and Construction

Like most industries, building design and construction has been hit hard over the past 18 months due to the coronavirus pandemic. Whilst there was a certain amount of support and monetary relief from the government, as the UK gets back to some form of normality, 2021 has seen a raft of tax changes for the ... Read more

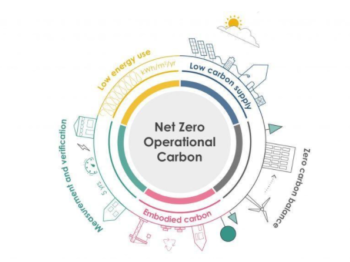

Is Net Zero Carbon Construction Really Possible?

Most of us remember the Extinction Rebellion’s protests in 2019 against climate change. Whilst they caused untold disruption at the time – maybe they went a bit too much over the top and lost some of their impact – no one can deny the media attention they drew towards the impact of climate change on ... Read more

Are Innovation and Incentivisation the Answer to Climate Change?

Even if you don’t watch or read the news, you can’t have missed the rampant wildfires in Canada, and much closer to home in Greece, wiping out entire villages and towns. You can’t have missed the devastating, destructive floods that tore communities apart in Europe. Even in the UK, torrential rainfall flooding not just the ... Read more

What You Need to Know About the New Super Deduction Allowance

In this year’s Budget, Rishi Sunak, Chancellor of the Exchequer, announced the new Super Deduction Allowance, as part of the Finance Bill 2021, whereby businesses are able to claim for any expenditure they’ve incurred on new fixed assets of plant and machinery. The new allowance is only for the actual expenditure incurred between 1st April ... Read more

An introduction to capital gains tax

Wilby Jones Consulting’s experienced tax advisors are able to assist you with a wide range of complex tax issues, including capital gains tax. If you intend to sell one of your assets in the near future, it may be worth first spending some time on tax planning. Here’s everything you need to know about capital ... Read more

Our take on the Spring Budget 2021

It’s been a gruelling 12 months for the UK economy, so we were interested to see what restorative measures the Chancellor, Rishi Sunak, would deliver in his March 2021 Spring Budget statement. Here are five of the biggest changes the Chancellor delivered, along with our take on how they could affect us, our clients, and ... Read more

What are capital allowances, and who can claim them?

Your business may be eligible for capital allowances if it has invested money in permanent assets for the company. Capital allowances are just one of the many specialist tax relief services we provide at Wilby Jones Consulting. Keep reading to find out more about capital allowances, and if your business could be eligible… What ... Read more

Christmas message from Simon and Darryl

As we wrap up an exciting year of business, Wilby Jones Consulting partners, Simon and Darryl, would like to share a seasonal message with their community of staff and followers… What a year we have had! Since deciding to branch out into Wilby Jones Consulting in early March, the business has gone from strength to ... Read more

Five reasons R&D tax relief is the perfect Christmas gift for your business

As we wrap up what has been probably the most unsettled year in living memory, it’s time to start planning for the next 365 days. As you do your Christmas shopping for your loved ones this festive season, don’t forget to treat your business, too. While none of us can know what 2021 will bring, ... Read more

Who can claim R&D tax relief?

One of the most common queries we receive here at Wilby Jones Consulting concerns the eligibility of businesses for the R&D tax relief scheme. Many businesses aren’t sure if they’re entitled to benefit from the R&D tax relief incentive. We’re here to set the record straight: businesses from any sector can potentially make use of ... Read more

Q&A with Gordon Haxton of Haxton Chartered Accountants

While most of our clients come to us directly, this isn’t always the case. We have something of a referral scheme established with a trusted accountancy firm, Haxton Chartered Accountants. If they have a client that they think could benefit from some tax advice, they refer them over to Wilby Jones Consulting. We sat down ... Read more

FAQs about R&D tax relief

Although R&D tax relief is an incredibly rewarding statutory tax scheme, it is often misunderstood. To help more businesses benefit from this tax reduction incentive, we’re happy to spend time educating prospective clients on the ins and outs of R&D tax relief. Here are just a handful of the questions we’ve been asked about R&D ... Read more

Five things we’ve learned from HMRC’s R&D Tax Credits Statistics Report

Every year, HMRC releases a number of statistics in a report on the recent R&D tax relief claims. These statistics provide a deep dive into the state of R&D tax relief in the UK. In more practical terms, they provide information on: The number of businesses making R&D relief claims What businesses are claiming for ... Read more

What to look for when choosing an R&D consultant

Interested in exploring R&D tax relief for your business? Time to choose a specialist R&D adviser. The right consultancy can mean the difference between a successful R&D claim, and a large headache for your business. In this article, we’ll run through what to look out for, and what to avoid, when it comes to choosing ... Read more

Exploring remote working and its impact on innovation

Over the last few months, working remotely has become part of everyday life for many businesses. Although many companies are now opening their doors to staff, others have no intention of instigating a mass ‘return to work’. As the way we work has changed dramatically, we must negotiate a number of challenges if we are ... Read more

Why HMRC rewards innovation in UK businesses

HMRC’s R&D tax relief scheme isn’t just a nice ‘perk’ for UK businesses: it’s a strategic incentive designed to encourage innovation. Keep reading to find out why… The R&D tax relief incentive reduces the amount of corporation tax that businesses have to pay. If you can prove to HMRC that your business spent money on ... Read more

Your guide to R&D tax relief

Welcome to Wilby Jones Consulting’s guide to research and development (R&D) tax relief. R&D tax relief is one of the most lucrative, yet under-utilised tax incentives. There are over 2.1M SMEs in the UK, and less than 5% of them claim R&D tax relief. Launched by HMRC in 2000, R&D tax relief intends to stimulate ... Read more

Claiming research & development tax reliefs

The UK government offers Research and Development (R&D) reliefs. These tax credits support businesses that work on innovative projects in science and technology. It can be claimed by a range of companies that seek to research or develop an advance in their field. It can even be claimed on unsuccessful projects. You may be able to ... Read more

Who can claim R&D expenditure in tax credits?

We will begin with a clear statement: R&D tax credits are not restricted to particular industries. Examples of projects that might qualify for R&D tax relief include: research and development of a new process, such as a more efficient manufacturing technique; developing and producing a model, like a more energy-efficient machine; working out original computer code ... Read more

Choose your R&D tax adviser with great care

If your company operates with any level of development or innovation it is likely you have been approached by several companies offering to assist you in making an R&D tax claim. As with any service, there are good companies, bad companies and downright poor companies. So how do you know who to work with? More ... Read more

Scottish (and English) businesses are missing out on R&D tax relief

Every year, we usually head north from our base in Norfolk to the delightful cities of Glasgow and Edinburgh on client meetings. If you know the transport network of East Anglia, you’ll be fully aware of what a mammoth operation this is as road and rail connections are, to put it politely, not up to ... Read more

Invest in innovation and reap rewards with R&D tax relief

Everyone likes an alliterative title opening, don't they? Takes you back to school days where you mastered similes, metaphors and alliteration along with other figurative language devices. Today though, that title (alliterative again - last one we promise!) rings true for so many companies, with many unaware of the tax savings they can make from ... Read more

R&D tax relief and Covid-19

Research and Development (R&D) reliefs support companies that work on innovative projects in science and technology. It can be claimed by a range of companies that seek to research or develop an advance in their field. It can even be claimed on unsuccessful projects. We know it's become something of a cliché but we think ... Read more

Meet the Team: Business Development Manager – Sean Devine

This time we’ve put former marine Sean Devine under the spotlight as part of our meet the team series. Now our Business Development Manager, Sean reveals a bit about his life before and outside of Wilby Jones, as well as what his working day looks like... Can you tell us a bit about your role: ... Read more

Meet the Team: Tax Advisor – Ben Thompson

Can you tell us a bit about your role: how do you fit into the company, and what does your day-to-day work look like? In my role on the Research and Development team, I work with a broad range of clients across several industries including engineers, software developers, food and drink companies and architects. My ... Read more

Meet the Team: Amy Johns, Senior Tax Associate

In the hot-seat this month is Amy Johns. Amy joined us just over six months ago but is already going from strength to strength: she has just been promoted to Senior Tax Associate! Here's a little bit about what makes Amy tick... Can you tell us a bit about your new role: how do you ... Read more

Meet the team: Jess Grief, Senior Tax Associate

Over the last year, Wilby Jones Consulting has gone from strength to strength. Part of that success is down to our amazing team: in just 11 months, we’ve grown from just three people to a team of 12! To help you get to know the people behind Wilby Jones, we’ll be profiling a different team ... Read more